February 27th, 2026

Oil has regained its pre-pandemic highs, lumber has more than doubled in price from last year, and precious metals like platinum and copper are multiplying investors’ fortunes manyfold.

But there’s another, more obscure commodity at the beginning of a bull market that could dwarf all of the above: carbon credits.

Source: https://www.icis.com/explore/resources/news/2021/03/18/10619064/energy-markets-align-amid-carbon-volatility

The price of a one-metric-ton carbon dioxide emission permit within the EU’s Emissions Trading System (ETS) has more than doubled from its pre-pandemic levels in the last few weeks.

So what are they, and how can you invest in them?

A carbon credit is a tradeable permit that gives its holder the right to emit one metric ton of carbon dioxide or a chemically equivalent amount of a different greenhouse gas like methane.

They’re usually rolled out as part of a cap-and-trade system (or ETS).

The EU ETS is by far the largest cap-and-trade system in the world, accounting for more than 90% of the global carbon credit market and sporting a market capitalization of more than $250 billion.

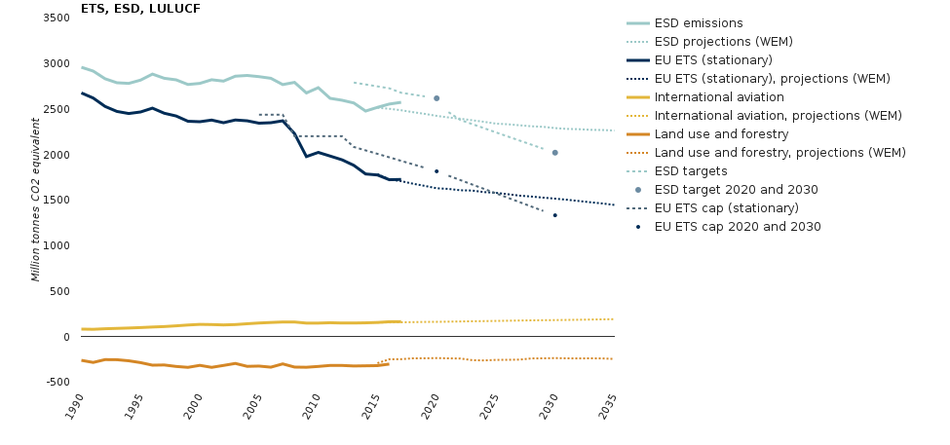

In a May 25 meeting of the European Council, the bloc announced plans to cut its carbon emissions by 55% by 2030 and by 100% (to net-zero) by 2050. As you can see below, that would involve a pretty heavy reduction in the supply of EU ETS carbon credits.

Source: https://www.eea.europa.eu/data-and-maps/indicators/greenhouse-gas-emission-trends-6/assessment-2

This supply-side pressure helped push the price of EU credits past €50 in early May, a key milestone many analysts were waiting for. Fund inflows have sharply quickened since that time.

The EU’s faith in its own ETS is also being buoyed by similar proposals elsewhere. In the U.S., the Business Roundtable and the Commodity Futures Trading Commission (CFTC) have both called for the U.S. to adopt an EU ETS-style national cap-and-trade system.

In sum, a combination of fundamental and technical factors is pushing EU carbon credits into a dizzying bull market that doesn’t seem to be anywhere near its end.

And our research team recently found two handy funds that can help individual investors profit from the incipient rally in this obscure asset class. They’ve compiled their findings into our latest free report, "How to Profit From the Bull Market in Carbon Credits."

Inside, you’ll find:

- A comprehensive explanation of why the EU ETS carbon credit bull market is just getting started.

- A “pure-play” fund that allows investors to directly benefit from ETS credit ownership with much less risk.

- A market-beating fund that gives investors indirect carbon credit exposure as well as many other shareholder benefits.

Simply enter your email to receive this completely free report. You’ll also receive a free subscription to our premium investment news and education letter, Energy and Capital.

Again, it’s FREE. Enter your email address below to claim your copy before it’s too late.